CryptoCorner

The United States is the world’s most cryptocurrency-ready nation, a study by a crypto education website concluded.

Crypto Head analyzed a range of factors, including number of crypto ATMs, accessibility to potential users, governmental stance on crypto ownership, whether or not cryptos such as Bitcoin can be used in banks, and the number of online searches to determine a country’s stance on the new worldwide currency.

The survey ranked the U.S. first followed by Cypress, Singapore, Hong Kong, United Kingdom, Ireland, Slovenia, Australia, Germany and Canada.

“Our research also found that the United States is the most crypto ready for consumers,” Adam Morris, co-founder of Australia-based Crypto Head, said in a report, “even though the government has been slow with regulation clarity over the last few years, which has actually driven most crypto business overseas.”

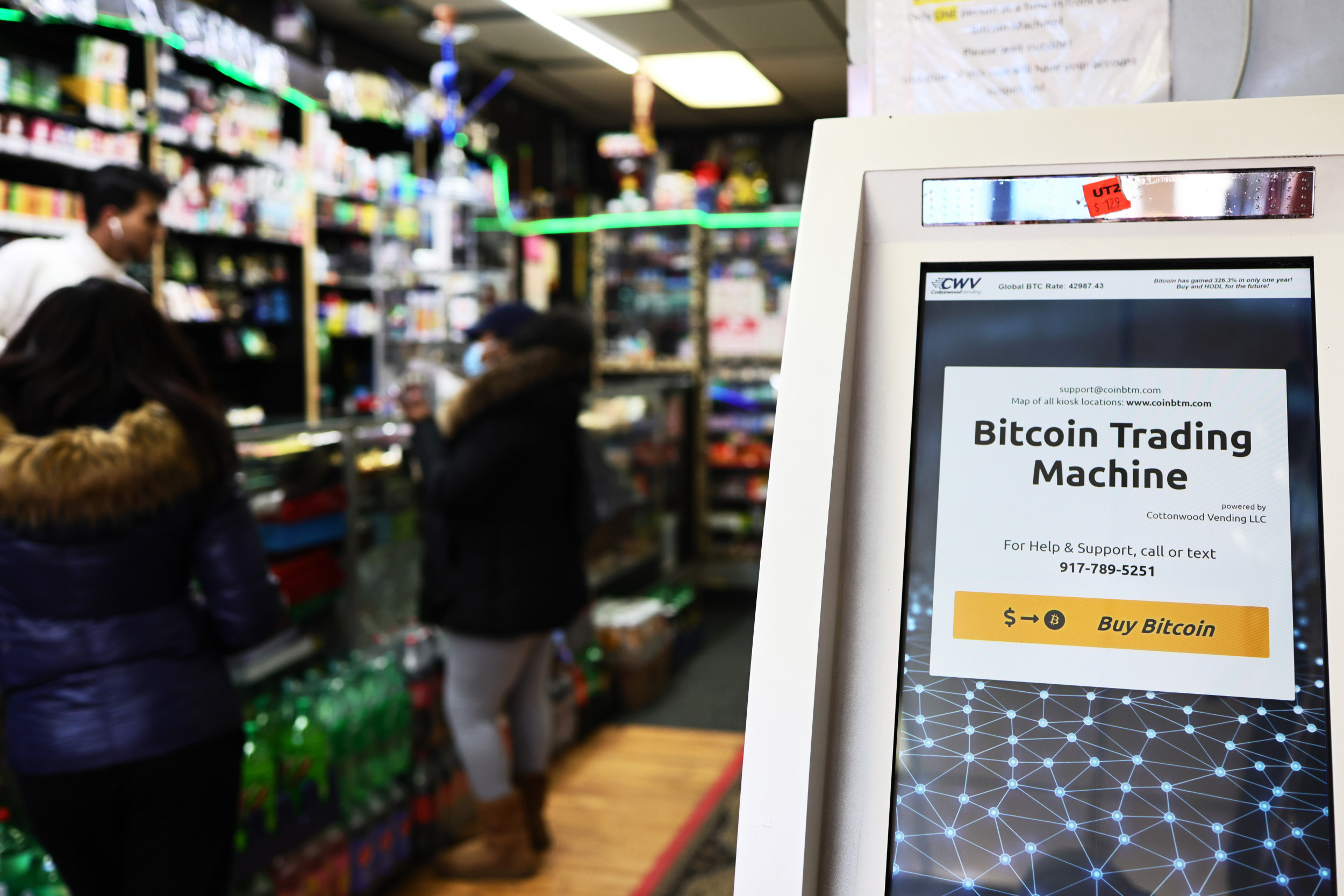

Michael M. Santiago/Getty Images

The study found there were 14,796 Google searches a year per 100,000 people in the U.S., far below the 33,941 per 100,000 conducted in Cypress, a tax haven. But the U.S. had 17,436 crypto ATMs, far out-pacing runner-up Canada with 1,464.

That means there are about 19,023 people per crypto ATM in the U.S. compared with 26,265 in Canada.

The survey reviewed key points between May 2020 and April 2021.

But the findings, while encouraging to cryptocurrency advocates, don’t suggest nirvana is around the corner in the U.S. Some experts cite security concerns, such as the need for increased regulation before investing.

But a study by Citi Global Perspectives & Solutions, widely known as Citi GPS, said that, “In total, just over 2% of the activity in the cryptocurrency space was linked to illicit activity in 2019, and that total was down to only 0.3% in 2020. However, the extent of such activity can often seem overblown based on news headlines alone.”

Nevertheless scams targeting the Little Guy appear to be a growing problem.

The Federal Trade Commission said consumers reported losses of about $82 million in crypto scams in the fourth quarter of 2020 and the first quarter of 2021 – more than 10 times the number for the same period a year earlier.

Many scams target small investors who lack experience in the sector and don’t have the secure custodial services offered to institutional investors by a major service provider such as Bank of New York Mellon.

Cryptocurrencies developed with little or no regulation.

In 2014, Janet Yellen, then chairwoman of the Federal Reserve, said the nation’s central bank didn’t have the legal power to regulate Bitcoin and other cryptocurrencies.

At the time, Bitcoin’s total market value was about $4.3 billion. At today’s price, the market cap is about 151 times greater, and that may be part of the reason the crypto is receiving greater scrutiny.

Yellen, now head of the U.S. Treasury Department, is determining if the agency has the authority to regulate payment networks.

No one expects the U.S. to clamp down on Bitcoin the way China has squeezed miners, but many have said regulating the on- and off-ramps, the exchanges and ways of converting crypto into dollars, would be an effective way to control it.

Some believe other aspects of the crypto world should be subject to future regulation.

Some have fretted that stablecoins, a cryptocurrency typically linked one-for-one to the dollar and whose value is largely based on faith in the issuer, could create a hazard.

This turns the world upside down for crypto advocates, who argue that Bitcoin will replace fiat currencies issued by governments thanks to the blockchain, the unbreakable record of each transaction that functions independently of any government.

Bitcoin and Ethereum are the largest cryptos by market cap, with Tether challenging for the third spot because, in part, the stablecoin allows an easy way to move money around or a way to park cash, without whatever objection some people apparently have in using dollars at commercial banks.

If there are problems with stablecoins, it appears they’d be similar to difficulties with established currencies.

But there may be a great unknown: Could Tether impinge and perhaps destabilize the dollar or other major currencies, or would it be a problem only for those who hold the stablecoin?

The U.S. House Committee on Financial Services is reviewing the potential risks and technological gains cryptocurrency may create as it considers possible legislation, but no clear direction has yet emerged.

Committee members seek to answer basic questions: Should cryptos be reined in or encouraged and if so, how?

At a recent hearing, Congressman Brad Sherman, a California Democrat, said, “Cryptocurrencies are highly volatile, so if one person makes a million dollars and retires at age 45, and nine lose $100,000, (crypto exchange) Coinbase makes money, and one millionaire goes on TV and says how wonderful it is, and nine others do not retire with dignity, but instead become eligible for Medicaid.”

But the other side of the aisle answered with a free trade argument.

“Over the last few years I’ve been fortunate to meet with many great crypto and blockchain innovators,” said But Tom Emmer, a Minnesota Republican. “A common refrain during our discussion is that they so badly want to develop their crypto and blockchain ideas right here in the United States, but they don’t because of continuing uncertainty with crypto regulation.”

In mid-day trading Wednesday, Bitcoin changed hands at $34,462.66, up 1.30% in the last 24 hours and up 19.08% for the year. The 24-hour range is $33,556.29 to $35,053.01. The all-time high is $64,829.14. The current market cap is $646.16 billion, CoinDesk reported.

MarketPulse

Consumers in the checkout aisle aren’t the only ones fretting about inflation.

Many of the nation’s supermarkets are stockpiling basics to protect their profit margins.

ROBYN BECK/AFP/Getty Images

It’s a reversal of COVID-19 panic when many consumers bought large amounts of food and household items because they feared spot shortages.

Surging demand has led to kinks in the supply chain, but many retailers fear continued inflation and are preparing for higher prices with large purchases of sugar, frozen food and other items with a long shelf life.

“We’re buying a lot of everything,” David Smith, chief executive officer of Associated Wholesale Grocers, told The Wall Street Journal. “Our inventories are up significantly over the same period last year.”

The wholesaler said it has increased inventory by 15% to 20%.

In the past, price increases have been limited to specific types of products, but current increases are larger and spread across a wide range of products.

Meat and produce costs have been rising. A number of food processors have announced price hikes to cover rising production costs, including General Mills and Campbell Soup.

There appears to be no relief in sight.

Labor is tight. Many employers therefore must boost wages to attract and retain workers.

Transportation costs are high and the price of crude oil continues to rise as demand increases, boosting prices at the pump for distributors and consumers.

From May 2020 to May 2021, the index of Personal Consumption Expenditures (PCE) rose 3.9% and the Consumer Price Index (CPI) increased 5%.

The Federal Reserve, the nation’s central bank, believes the PCE is the more reliable indicator of future prices. In June of last year, the Fed said it expected the PCE to increase between 1.4% and 1.7% through 2021. That’s within the Fed’s 2% target.

But at its meeting last month, the Fed boosted its estimate to 3.1% to 3.5% – and that may be too low.

Inflation appears to be accelerating. Most of the 3.9% increase in the PCE occurred this year.

If inflation continues to increase at a monthly pace of 0.4% to 0.5% as it has in the past, inflation could climb as high as 5% or 6% by the end of the year.

The Institute for Supply Management, a Tempe, Arizona-based non-profit research and education association, said its Purchasing Managers Index (PMI) grew for the 13th consecutive month in June, but was down from May’s level.

The PMI gauges manufacturing and service activity as it tracks the economy to help spot trends. The index indicates expansion, contraction or staying the same.

“The composite index is still in strong growth territory,” ISM Chairman Anthony Nieves recently told reporters on a conference call. “However, there are still impediments affecting the rate of growth—material shortages, inflation, employment resources and logistics challenges. All of these are putting pressure on supply chains.”

In a note to clients, Dr. Robert Dye, chief economist at Comerica Bank in Dallas said, “Ongoing supply chain strain and inflationary pressure, easing labor demand, less rapid rate of expansion after the spring surge. With the wind down of fiscal stimulus this spring and business conditions modestly normalizing at the end of the second quarter, we could see a step down in GDP growth from (the second quarter) to Q3.”

The fear: Shortages and price increases could become a drag on the economy and slow the recovery.

This news is republished from another source. You can check the original article here.

Be the first to comment