“Rashbehari, Hazra, Bhowanipore, Exide, Park Street…” and so on goes the rap of a bus ticket conductor in Kolkata. The speed at which he rattles off the names of upcoming bus stops can be fascinating, but not as much as the number of cryptocurrencies — and NFTs and top locations in Decentraland — that a 20-something could rattle off on cue (or without it), just a few months ago.

The recent crash in Bitcoin, Tether, Solana and their peers — as the latest run on crypto lender Celsius — isn’t just a price correction. It may not even be the end of a ‘fad’. What it definitely is: a reality check for an entire generation that saw the mirage of a libertarian ideal (loosely put, a truly free society where no one’s forced to play by the rules of a state) within its reach. It was cute.

Make no mistake. This isn’t just millennials and Gen-Zs taking him/herself too seriously. Like all things utopian, someone else would have dreamt of it earlier.

From Friedrich Hayek to James Dale Davidson and William Rees-Morg to our own contemporary Ron Paul (who had an altcoin named after him), have predicted, recommended or wished for a society where individual liberty will reign supreme and a currency, free of government control, will be an important tool in the making and survival of such a society.

The emergence of Bitcoin and its alternatives made it seem like the utopia was closer than ever. For those who didn’t care for the Elysian Fields — the equivalent of heaven in Greek mythology — on Earth wanted to make the most of the rising tide of perceived value.

The recent crash in the value of these private digital currencies, which tumbled along with other risk-bearing assets like stocks, has forced the fans to wake up and smell the coffee.

These are some realities that have dawned upon the dreamers. Ideology can’t be an excuse for financial indiscipline. Many borrowed money to buy bitcoin because the fear of missing out — FOMO, as the popular acronym goes — was stronger than rational investing principles. And, when they cut their losses and dump their holdings into the market, the prices fall even further, taking the rug from under those with higher risk appetite.

This can go on till everyone’s covered in a wet blanket or when new investments start flowing in. Financial indiscipline triggered by FOMO is not unique to crypto enthusiasts. Stock market investors around the world have done the same from time to time, including the times before the mega global crises in 1929 and 2008.

That brings us to the second fact about the world that has been bearing down on the cryptocurrencies too.

Big chunks of many cryptocurrencies, especially the smaller ones, are held by few people with a lot of money to spare. When they cut loose, they cause a lot of damage to a lot of people.

A similar concentration risk has been witnessed in Lido Finance, which rewards owners of a cryptocurrency called Ether for validating transactions on the network. This allows the owners to earn a passive income from their investment without selling their holdings of Ether.

One of Lido’s big clients, Celcius, pools customer deposits to generate this passive income and distributes it back (after keeping a cut for itself). This worked well as long as the value of staked Ether (the token given as reward or passive income) is worth the same as Ether itself and other participants in the market are willing to exchange that for other tokens.

So, whether it’s a run on a traditional bank or a decentralised finance platform, they look awfully similar. And, there aren’t as many people committed to crypto as the fans may want to believe.

The efficiency of any market depends on the number of participants in any market, whether it is cricket bats or cryptocurrencies. The more the merrier.

While the chaos and conversations around the crypto world can be consuming, there are just a few but very loud people in these parties. Just decibels don’t make the party ‘cool’. But they can attract the cops.

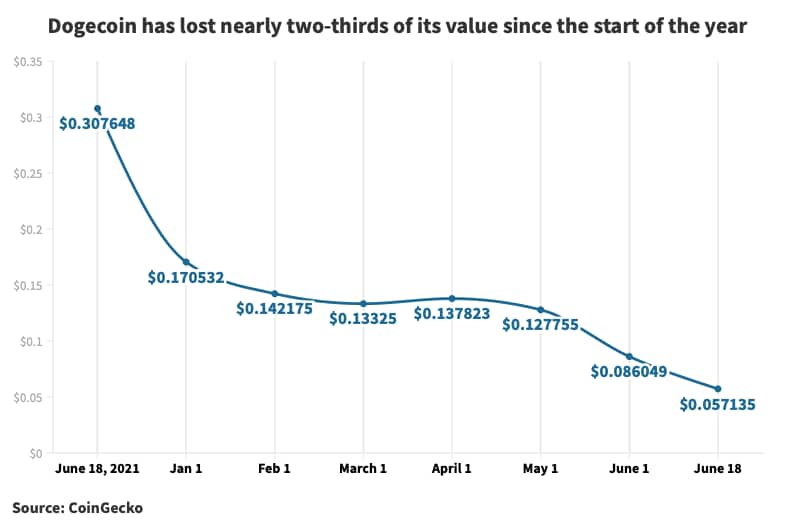

Influencers like Elon Musk (backing Dogecoin) can drive up the sentiment and prices with just tweets during the good times but their words don’t count for much when the tide turns.

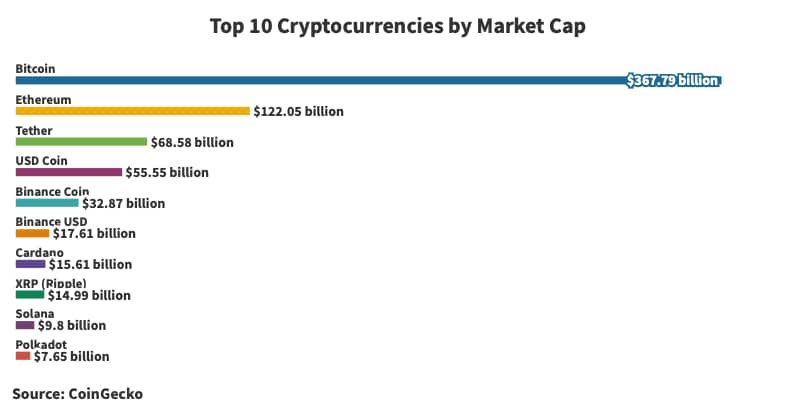

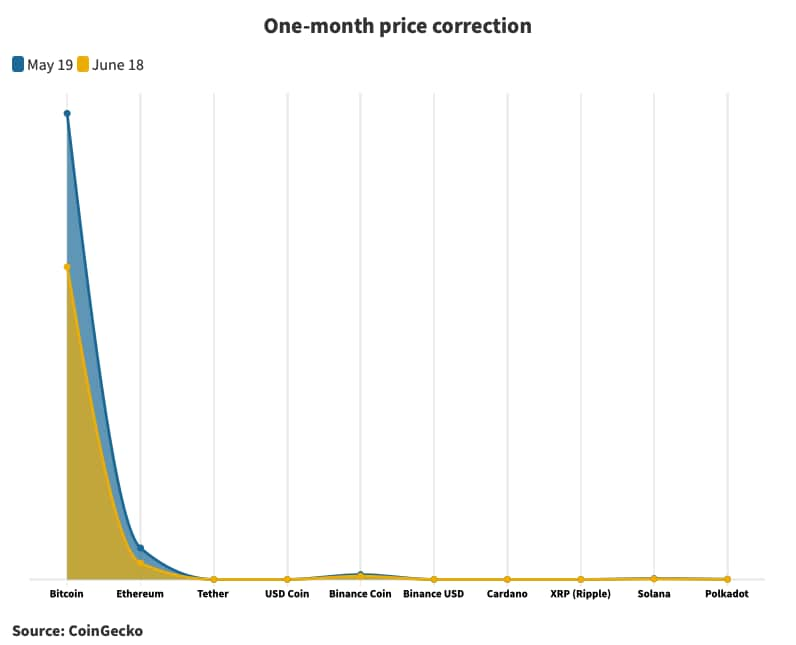

Even reading the crypto charts through the eyes of the brilliant, government-hating Hayek, who held that prices reflect everything you need to know about a particular product/service/asset, the following table would at best be depressing for the believers of bitcoin and its peers.

Even the French Connection Finance’s dividend-paying token is down nearly 16 percent in the last month.

Like many other forms of idealism, this one too, at a young age, rammed into the wall called reality. Maybe it will evolve, maybe it will come back with more intensity, maybe it won’t do either. What is more certain, I will still be on this side of a laptop jotting down my observations.

The author Sriram Iyer is Executive Editor, CNBCTV18.com. Views expressed are personal.

This news is republished from another source. You can check the original article here.

Be the first to comment